trust capital gains tax rate 2020

The tax-free allowance for trusts is. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000.

What You Need To Know About Capital Gains Tax

Figure the tax on the amount on line 18.

. Use the 2021 Tax Rate Schedule in the Instructions for Form 1041. A trust may only have up to 2650 in 2019 of taxable income and still be taxed at 0 on its capital gains and qualified dividends. Gifts over 17000 will reduce your lifetime estate and gift tax exemption.

The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. They would apply to the tax return. For tax year 2020 the 20 rate applies to amounts above 13150.

2019 to 2020 2018 to 2019. What is the capital gains tax rate for trusts in 2022. Some or all net capital gain may be taxed at 0 if your taxable income is.

Irrevocable trusts are very different from revocable trusts in the way they are taxed. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets. Income and short-term capital gain generated by an irrevocable trust gets taxed at high rates.

An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing. Capital gains and qualified dividends. The 2020 estimated tax.

The tax rate on most net capital gain is no higher than 15 for most individuals. Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2021. For tax year 2022.

The remaining amount is taxed at the current rate of capital gains tax for trustees in the 2020 to 2021 tax year. 18 and 28 tax rates for individuals the tax rate you. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000.

2022 Long-Term Capital Gains Trust Tax Rates. For tax year 2022. It continues to be important to obtain date of.

The maximum tax rate for long-term capital gains and qualified dividends is 20. Add lines 27 31 37 40 and 41. Find out more about.

Capital Gain Tax Rates. What is the capital gains tax rate for trusts in 2022. The annual gift exclusion was increased from 16000 to 17000 per donee for 2023.

At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed. The maximum tax rate for long-term capital gains and qualified dividends is. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income.

It continues to be important. The highest trust and estate tax rate is 37. The maximum tax rate for long-term capital gains and qualified dividends is 20.

Use these rates and allowances for Capital Gains Tax to work out your overall gains above your tax-free allowance. Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts tax-free allowance called the Annual Exempt Amount. Because tax brackets covering trusts are much smaller than those for individuals you can quickly rise to the maximum 20 long-term capital gains rate with even modest profits.

The maximum tax rate for long-term capital gains and qualified dividends is 20. Capital gains and qualified dividends. In 2020 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year.

Mechanics Of The 0 Long Term Capital Gains Rate

How Are Capital Gains Taxed Tax Policy Center

The Tax Impact Of The Long Term Capital Gains Bump Zone

How Do State And Local Individual Income Taxes Work Tax Policy Center

Trust Tax Rates And Exemptions For 2022 Smartasset

Tax Advantages For Donor Advised Funds Nptrust

Trust Tax Rates And Exemptions For 2022 Smartasset

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

2022 Capital Gains Tax Rates Federal And State The Motley Fool

Generation Skipping Transfer Taxes

Capital Gains Tax Strategies How To Protect Your Assets And Stay On Track For Retirement Cambridge Trust

What You Need To Know About Capital Gains Tax

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

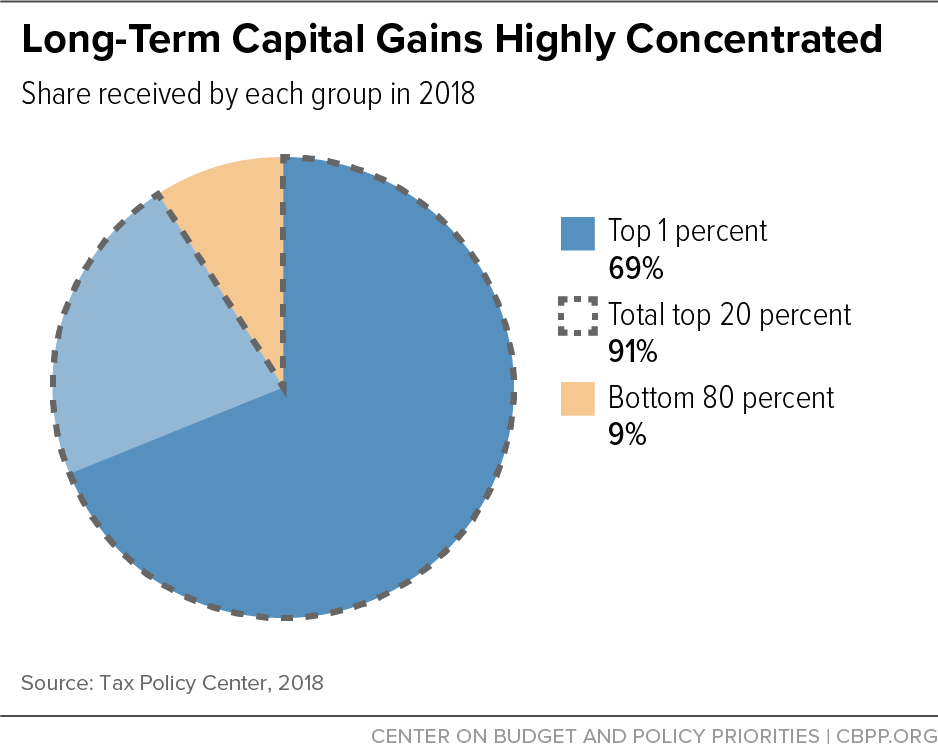

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

What Is The Capital Gains Tax Rate For Trusts In 2020 Youtube

What Is The Capital Gains Tax How Is It Calculated And How Much Will You Pay Kiplinger